Return on Equity Meaning

Return on equity ROE is a measurement of how effectively a business uses equity or the money contributed by its stockholders and cumulative retained profits to produce income. This is because there is uncertainty.

Return On Equity Examples Advantages And Limitations Of Roe

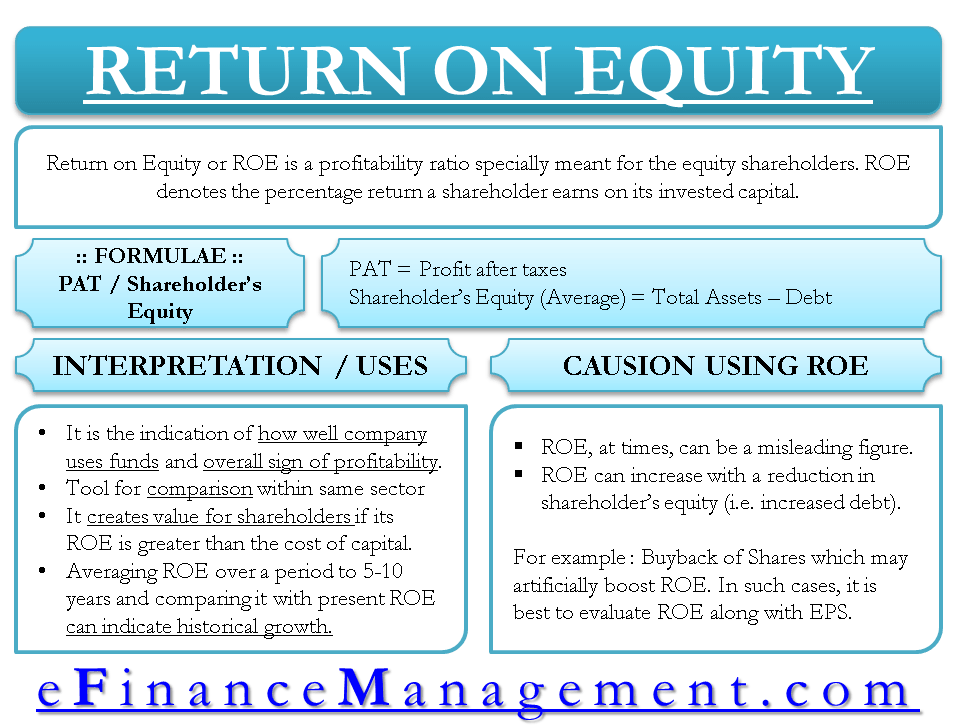

Return on Equity ROE is one of the few ratios that uses after tax profits.

. Return on equity tells the shareholders how many dollars of post-tax earnings the company generated for every dollar of equity capital it had. The denominator is essentially the difference of a companys assets and liabilities. In other words ROE indicates a companys ability to turn equity capital into net profit.

ROE is a gauge of a corporations profitability and how efficiently it generates those profits. This is measured on a. The Return on Equity or ROE measures how efficiently a company uses Shareholders Equity to generate profits.

You may also hear ROE referred to as return on net assets. Return on Common Equity is used by some investors to assess the likelihood and size of dividends that the company may pay out in the future. The measurement is commonly used by investors to evaluate current and prospective business investments.

In other words it is how much income the company is generating relative to the amount of capital received from shareholder investments. The return on equity ROE is a measure of the profitability of a business in relation to the equity. Return on equity is a common financial measure where you divided a companys net income by its shareholders equity.

Essentially ROE will equal the net margin multiplied by asset turnover multiplied by financial leverage. ROE can also be thought of as a return on assets minus liabilities because shareholders equity can be computed by adding all assets and removing all liabilities. The return on equity ROE is a measure of a companys profitability in relation to its equity.

The Return on Equity ROE figure does not take into account the outstanding share warrants. The return on equity ROE ratio sometimes called return on net worth is a profitability ratio that allows business owners to see how effectively the money they invested in their firm is being used. Because shareholders equity can be calculated by taking all assets and subtracting all liabilities ROE can also be thought of as a return on assets minus liabilities.

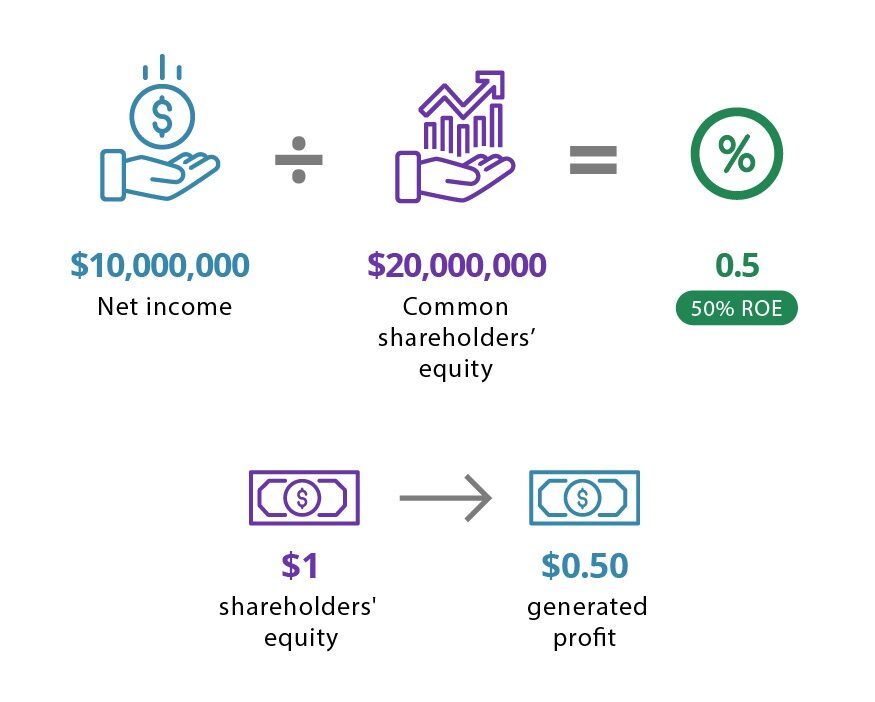

Return on equity is usually seen as. Return on equity ROE is the measure of a companys net income divided by its shareholders equity. What is the Return on Equity.

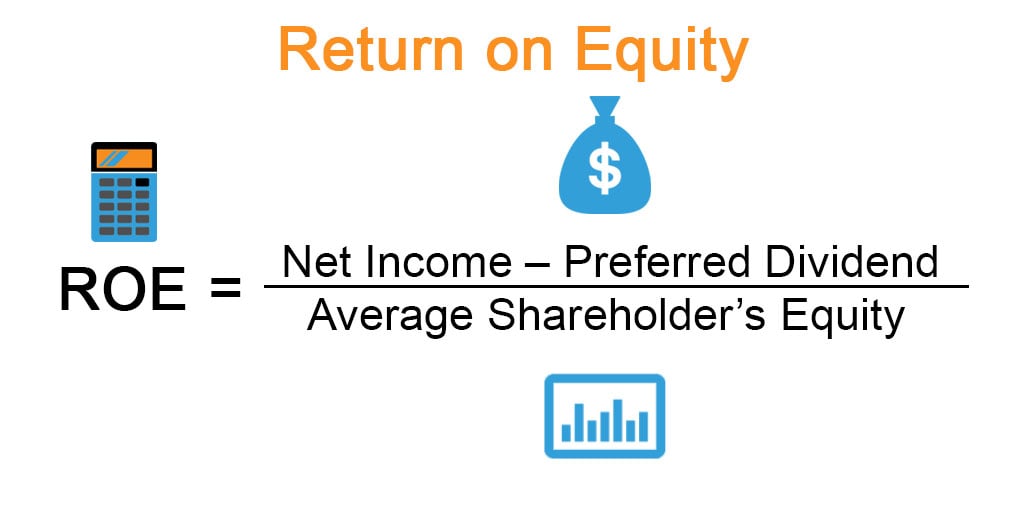

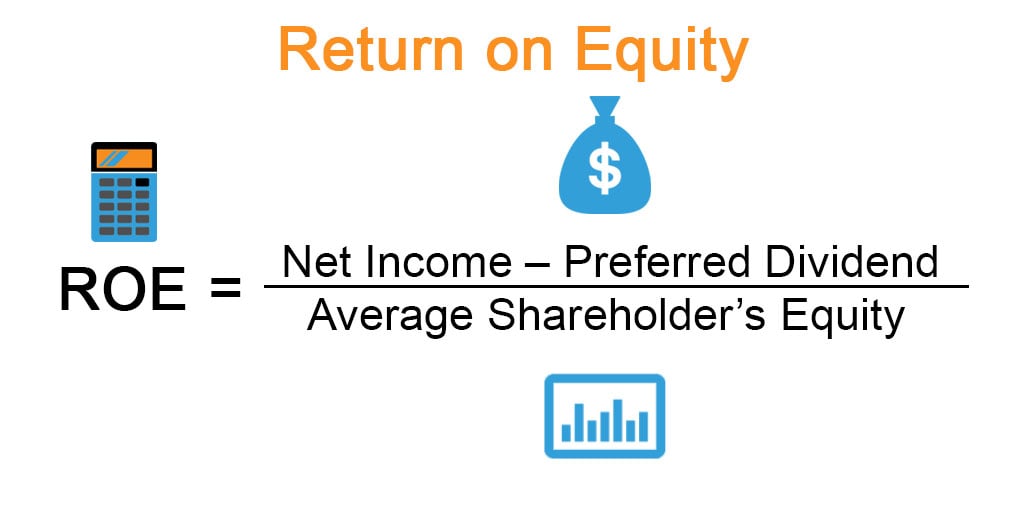

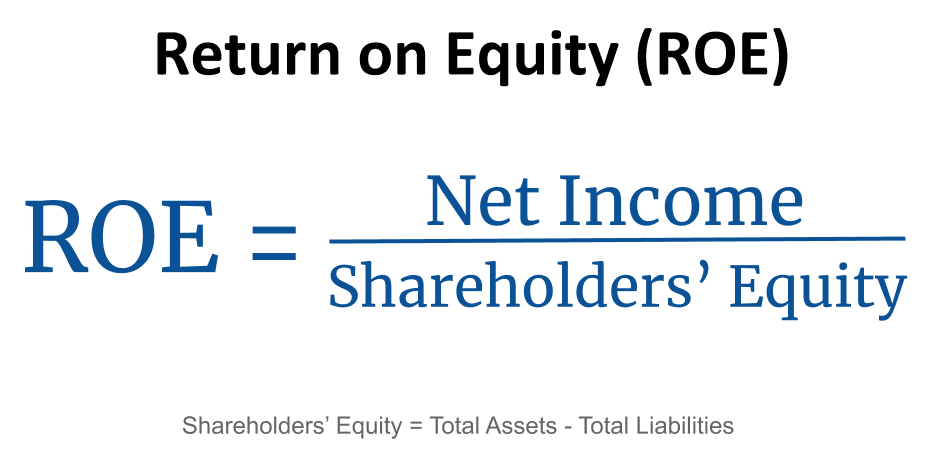

The DuPont formula is a common way to break down ROE into three important components. Mathematically Return on Equity Net Income or ProfitsShareholders Equity. Return on Equity Meaning.

The return on equity ratio reveals the amount of return earned on the shareholders equity invested in a business. Think of it as the return a company is getting on its assets. Return on equity ROE is a financial ratio that shows how well a company is managing the capital that shareholders have invested in it.

This in-depth Return on Equity ROE tutorial explains everything there is to know about ROE from its definition to its formula calculations and interpret. It is calculated as the Net Profit for the year divided by Average Book Value or Equity for the period. Return on equity ROE is a measure of a companys profitability against its equity expressed as a percentage.

Return on equity ROE is a measure of financial performance calculated by dividing net income by shareholders equity. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. ROE calculates how much profit is earned for every rupee.

Return on equity reveals how much profit a company earned in comparison to the total amount of shareholder equity found on the balance sheet. In essence when you calculate return on equity your objective is to measure how well is a company generating a return or profits in relation to the shareholders equity. A high ROCE indicates the company is generating high profits from its equity investments thus making dividend payouts more likely.

ROE measures how many dollars of profit are generated for each dollar of shareholders equity.

Return On Equity Roe Calculation And What It Means

Return On Equity Interpretation Meaning Investinganswers

Return On Equity Interpretation Meaning Investinganswers

Return On Equity Roe Formula Definition And More Stock Analysis

Return On Equity Roe Formula Examples And Guide To Roe

0 Response to "Return on Equity Meaning"

Post a Comment